So … tax time is here.

Maybe you’re freaking out. Maybe you think you’re unprepared. Maybe you’re overwhelmed. Maybe you feel like you don’t know where to start.

Do you worry that you’ll owe and won’t have the money put aside? Are you worried you’ll do something wrong and get in trouble?

Don’t! Tax time doesn’t have to be scary.

Running a successful photography business is 80% business and 20% photography. And taxes fall into that business bucket. It’s a necessary evil. You don’t have to love it, but the sooner you accept it as a part of being an entrepreneur and learn to best deal with it, the easier it becomes!

The best time to plant a tree?

There’s a Chinese proverb that says:

The best time to plant a tree was 20 years ago.

The second best time is now.

To prepare for taxes, it’s best if you’re … err … prepared!

When you plan for taxes, they aren’t scary; they’re just another thing to do. And you’ll know what to expect. Plus – when you have the right help, it’s not even something that you have to do yourself! Bonus! More on that later …

Tax time can be a walk in the park

Sprout Studio is a studio management suite built for photographers by photographers. I’ve been where you are. I know what it’s like to run a photography business. You automatically follow business (and tax) best practices when you use Sprout.

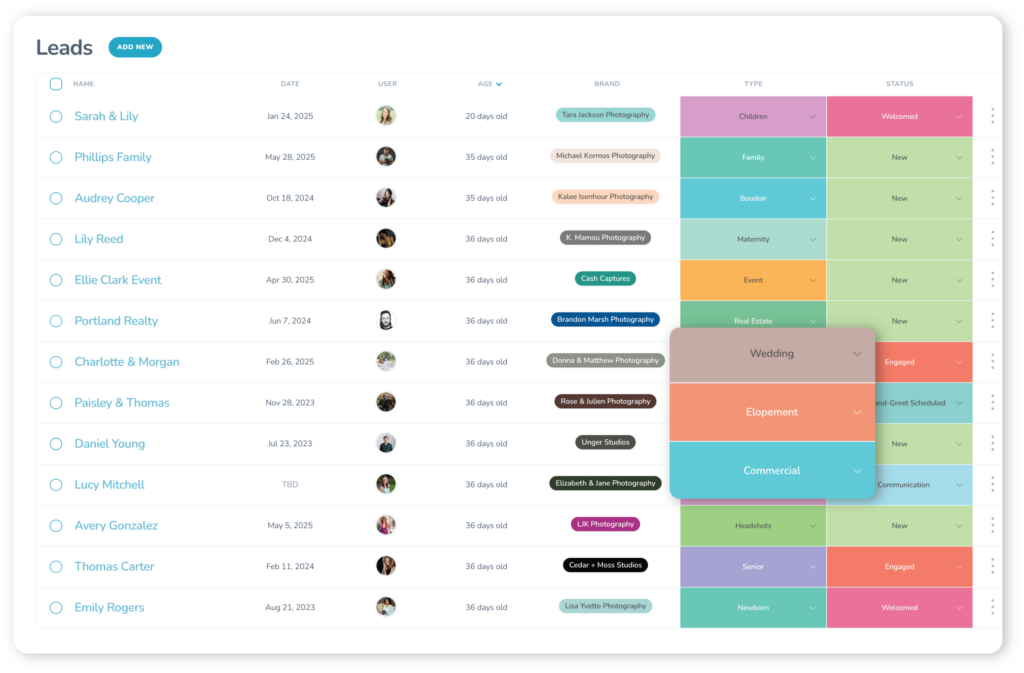

Here are 7 ways Sprout Studio makes tax time a breeze.

Tax tip #1 – Set up your taxes in Sprout Studio

Set up your taxes in Sprout, so your invoices automatically charge taxes. In Sprout, you can set up as many taxes as you’d like, and you can even group your taxes. So it’s easy to set up taxes according to your local and federal tax laws.

You can have Sprout charge taxes on each invoice within an order, or you can have Sprout defer the taxes to the last invoice within an order. These are two different tax collection methods, and I’d certainly suggest talking with your accountant about which is best suited for your business.

For each order in Sprout, you specify which tax is to be charged. You can even exclude specific items in an order from being taxable – which is helpful for many photographers who have to follow particular tax laws.

Tax tip #2 – Use Sprout to invoice your clients

Use Sprout for every client invoice. Sprout is your home-base and the hub of your business, so there’s no need to create invoices using a Microsoft Word document manually or to issue invoices from other software.

Sprout does it all for you!

Every time you need to collect money from a client, invoice them using Sprout. That’ll keep everything organized for you, for your clients, and it’ll make the rest of the steps simple!

Tax tip #3 – Turn on automatic invoice reminders

To file taxes, revenue is usually helpful. Err … I’d even argue that it’s required! To generate revenue, your clients need to pay you.

Sprout can help make that easier and less painful! Set up Sprout Assistant to automatically send out email reminders when invoices are due so you get paid on time, and you don’t have to waste your time manually following-up with clients.

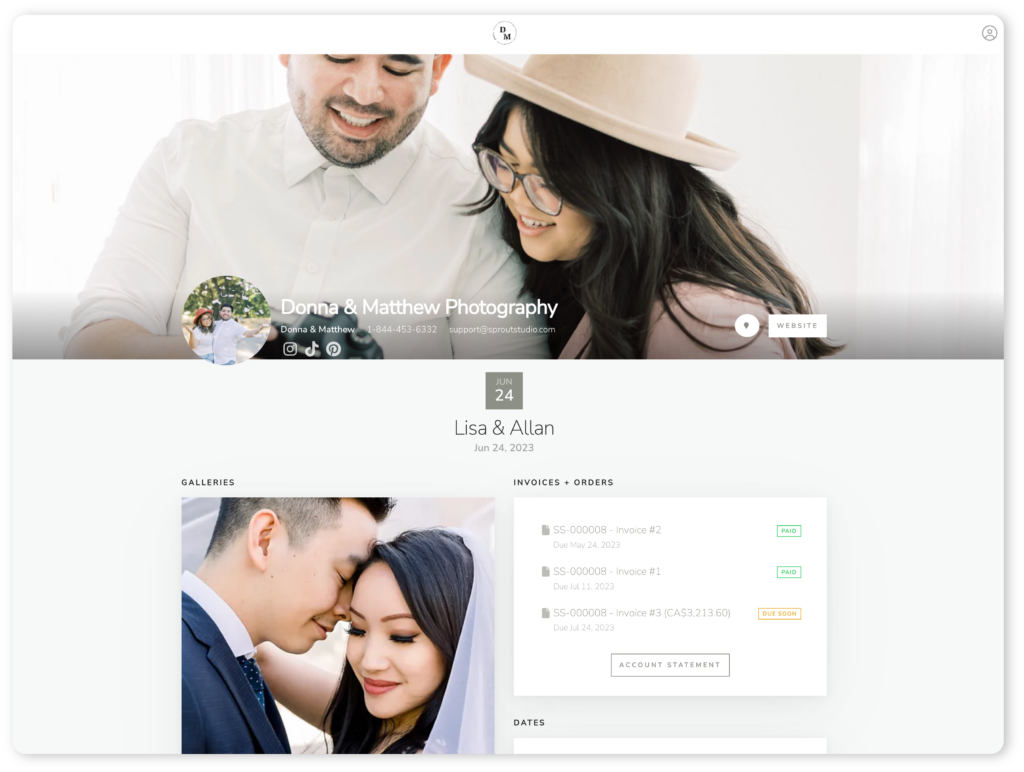

Tax tip #4 – Set up payment processing

Your clients can pay their invoices online (on their Sprout invoice) with their credit card. That money can automatically be transferred to your bank account with zero hassle.

You can integrate your Sprout Studio account with:

- Square

- Stripe

- PayPal

Using a payment processor saves you a ton of time from having to manually cash cheques or manage (and keep track of) e-transfers.

Tax tip #5 – Print off every invoice payment

Every time a client pays you, you get a notification turned on in Sprout Studio. By the way – if you don’t have those turned on, turn them on!

Every time you get a notification for a payment, print it!

Keep a physical folder, labelled for each month (this will help in a later step, too) and put a printed copy of each invoice payment into a folder for that month.

At the end of the month (or the end of the year), everything is organized and ready for your bookkeeper or accountant. More on that later, though.

Tax tip #6 – Track your mileage in Sprout Studio

Did you know that you can write-off your car expenses and mileage as a business? I won’t get into all the details here because it will vary for every photographer. You should talk with your accountant about the details, though, because it can be a great tool in your tax-time toolbelt!

But – did you know that you can track your mileage in Sprout?

Every time you drive anywhere for your business, track it in Sprout! This makes write-offs for vehicles, gas, and other related expenses a breeze!

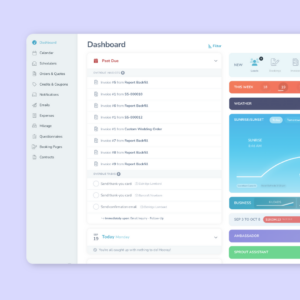

Tax tip #7 – Check in on your business health

Sprout Studio has a dozen helpful reports and analytics. Use them to your advantage – they aren’t just there to be pretty!

Give yourself a reminder to check in on your reports at least monthly. As it relates to this tax-time guide, checking in on your sales tax report will give you a ballpark of how much sales tax you’ve collected.

Now – it needs to be said – I don’t recommend using the sales tax report as the “be-all-and-end-all” for your taxes. Taxes are way more complicated than that, which is why I recommend hiring an accountant. But use the sales tax report as a point of reference so you can see how much tax you’ve collected. It will give you a good indication of how much you can expect to remit.

Remember – tax dollars are not your dollars. You collect it from your clients and hold it for the government until you have to remit it. That’s why you should know how much you’ve collected on an ongoing basis. You should even be putting that money into a separate account because it’s not yours! Believe me – the last thing you want is to be stuck with is a $10,000 tax bill without any money put aside to pay for it!

How to make tax-time a little less scary

Planning is key.

Your bookkeeper and accountant (more on that in a few) will give tips on how to prepare and stay on top of your taxes. But from one photographer to another, here’s a rapid-fire list of best practices that you should put into play right away to make tax-time a little less scary:

- Hire a bookkeeper for your monthly bookkeeping. Your time isn’t best spent doing your own bookkeeping – you don’t make money when you do your bookkeeping. You make money when you’re selling and shooting. Spend your time there.

- Hire an accountant for your year-end accounting. Make sure that your bookkeeper and accountant are on the same page – a lot of firms will be able to provide both services for you under one roof. Don’t try to do your own taxes. A good accountant will save you more money than they’ll cost you, so don’t even bother wasting your time trying to do it yourself.

- Keep a separate business bank account and credit card.

- Pay yourself a salary, and pay yourself first.

- Make sure you’ve priced yourself appropriately. Tax time is usually when most photographers find out that they didn’t make any money the previous year because their prices were too low.

- Keep every receipt for every expense. Put it on the same folder we talked about earlier that you’ll keep for each month. That way you have one folder for each month of the year with all of your income and expenses neatly organized. You’ll save boatloads of cash on your bookkeeping bill that way.

What to do when you haven’t prepared for taxes

We talked about this earlier, but it bears repeating …

The best time to plant a tree was 20 years ago.

The second best time is now.

The best time to start planning for taxes? Last year. 2 years ago. 5 years ago. And the better your workflow and the more organized you can be, the easier tax time becomes.

But – maybe you’re reading this guide because you’re freaking out. Maybe you didn’t plan properly. Maybe you didn’t follow the best practices above, and now you’re worried.

It’s ok. I won’t slap you on the wrist.

… hard

Kidding. It’s ok. This business thing is a constant learning process.

If you didn’t plan, didn’t prepare and didn’t keep track of things the way you should have, and if you’re not sure where to begin for tax time, here’s a simple 6-step process:

- Hire an accountant.

- Print off a receipt from every payment you’ve received from your clients.

- Gather up (and print off) every receipt for every expense you’ve had.

- Use the Sprout Studio Tax Report to get a quick glance at how much tax you can expect to owe. Start making plans to gather that money up.

- Give all of the above to your accountant and be prepared for the loose ends and many questions. You’ll likely have to spend a few days with your accountant and answering questions to clear things up before they can finalize your taxes. But they’ll help you get through it.

- Start planning and follow the best-practices above, so you don’t have to play “catch up” ever again.